Switching to solar can be a great way to cut energy costs, but navigating the tax credits that help make it affordable isn't always straightforward.

One homeowner went to Reddit's r/solar community after realizing they may have misunderstood how the federal solar tax credit works — and their post became a cautionary tale for anyone considering solar.

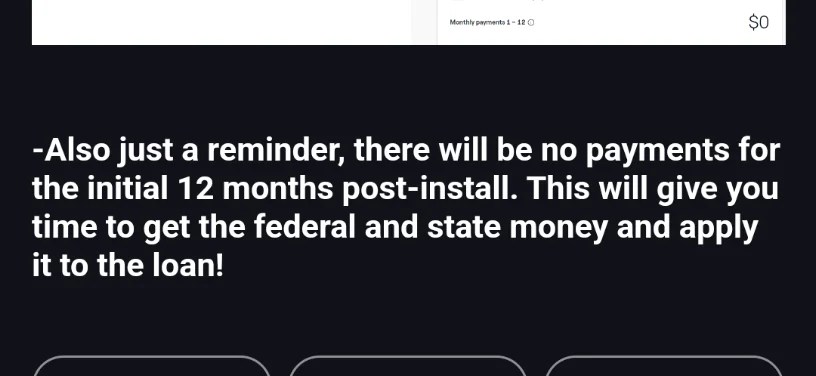

The Redditor explained that a solar rep sold them on a $55,000 system, saying they'd qualify for a 30% federal tax credit plus a state rebate, which would drop the cost to just over $20,000. The rep also told them they wouldn't have to make payments for the first year, supposedly giving them time to collect those incentives and put them toward the loan.

But after talking to a family member, they realized something important wasn't fully explained. The federal solar tax credit isn't a rebate or a direct payment — it's a credit that lowers the amount of federal income tax owed. If someone doesn't owe enough in taxes to use the full credit in one year, they have to roll over the rest to future years instead of getting the full amount upfront.

Feeling frustrated and unsure what this meant for their finances, the homeowner turned to Reddit: "Am I missing something here, or did the solar rep totally mislead me? Am I about to be stuck with a way bigger loan balance and payment than I expected?"

The tax credit can still lead to big savings, but only if you know how to use it. Since it lowers the amount you owe in federal taxes, the key is understanding how much of it you can actually claim each year.

Knowing this ahead of time can help homeowners avoid unexpected costs and make the most of their solar investment. And if you don't owe enough to use the full credit in one year, you can roll it over to future years and still get the savings.

Solar helps cut back on the use of dirty energy, which means less pollution adding to the planet's warming. Teaming up solar panels with smart energy tools like Arcadia and WattBuy makes it even easier to tap into clean power while keeping costs down.

Redditors chimed in with advice for the concerned homeowner.

|

Which of these factors is the biggest obstacle preventing you from getting solar panels? Click your choice to see results and speak your mind. |

One commenter said, "You need to make a certain amount and pay a certain amount in taxes to get the refund."

Another wrote, "Just adding that having tax liability is not the same as owing money after filing your taxes. It just means you owed taxes and they were right to take them out of your paycheck basically."

Going solar remains one of the best ways to cut energy costs and reduce pollution, but it pays to do your research. The Inflation Reduction Act currently offers generous solar incentives, but those may not be available forever. President Trump has stated he wants to eliminate clean energy subsidies. While any major changes to the IRA would require congressional approval, its future is uncertain. Acting now could mean locking in thousands of dollars in savings.

Upgrading to a smart home or weatherizing your house can further reduce costs and lower environmental impact. By staying informed and using tools like EnergySage to compare options, homeowners can ensure their switch to solar is a smooth, cost-effective move toward a cleaner energy future.

Join our free newsletter for easy tips to save more and waste less, and don't miss this cool list of easy ways to help yourself while helping the planet.