Everything's bigger in Texas — and insurance policy costs are no exception, especially as insurers raise rates because of concerns about climate crisis-fueled weather events.

What's happening?

Bad weather is causing more than just storms in Texas. ABC affiliate KVUE reported that Progressive is just one of several home insurance companies that have exited the market, or significantly limited the coverage they are offering, in the Lone Star State because of fear of storm-related damage.

According to Cassie Brown, commissioner of the Texas Department of Insurance, these departures will impact 11,000 homeowners. "Several companies are making some decisions to not grow as fast in Texas as they have been in the past," she said. "It could be that they are … increasing their deductibles. They may say this is a particular area of the state where we've seen a lot of losses. So we're not going to grow as fast."

While it's concerning for homeowners, insurers are sustaining losses from storms. KVUE cited Progressive's quarterly reports, which stated that 40% of all recent storm losses occurred in Texas.

"The carriers just can't provide the capacity that they need to write everywhere," risk consultant Frank Barbella explained.

Why is losing home insurance coverage concerning?

DeAnn Fraser, a resident whom KVUE interviewed, voiced her concerns about how these coverage changes would impact homeowners.

"It's going to leave people uninsured or underinsured because they're going to cut back on full coverage that they really need just to make it affordable so they have something," she said.

Fraser added: "It's gonna leave people uninsured or underinsured because they're gonna cut back on full coverage that they really need just to make it affordable, so they have something."

Barbella echoed her worries, saying that 100% of his clients were affected by the increased rates and limited competition. "Someone that we insured with a carrier … was paying around $2,000, and the renewal from that same carrier with no claims went to $10,000 in one year," he told KVUE.

Homeowners across the country have faced similar issues, as claims from flooding, wildfires, rising sea levels, tornadoes, hurricanes, and more have caused insurers to grow skittish in what they view as risky markets.

Given the fact that these extreme weather events are directly aggravated by human-caused rising temperatures, these patterns are on track to continue.

What can homeowners do?

For some homeowners, losing coverage means they'll have to move cities or even states in order to avoid having to pay for costly repairs out of pocket. Homeowners can put pressure on business and political leaders to take the warming planet and extreme weather conditions seriously.

Others are accepting the price increases for now, trying to shop in advance of renewal season to find deals and compare options. And some are opting to live without coverage, looking instead to protect their homes as best they can and work to prevent damage being done.

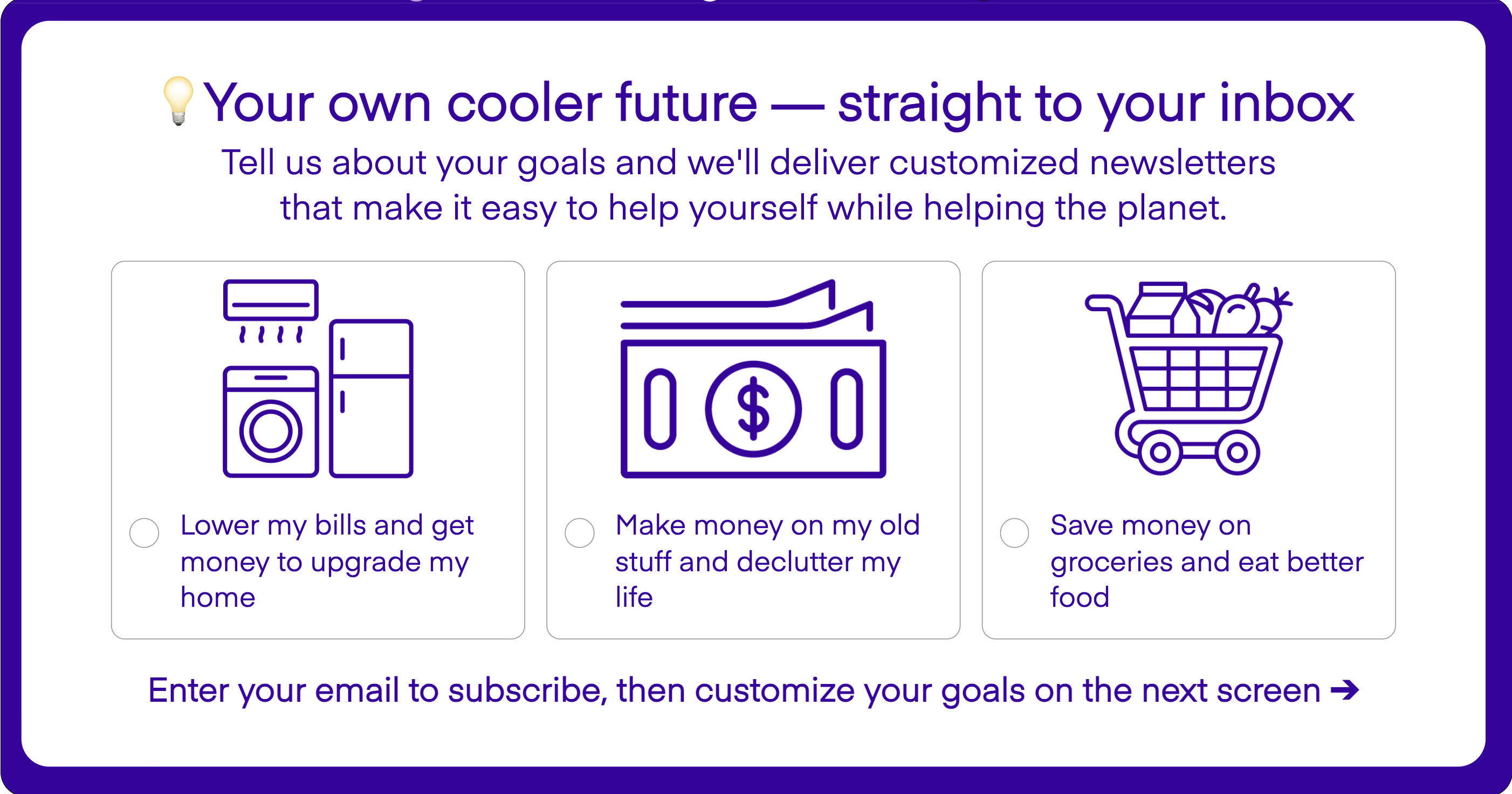

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.