Tesla recently announced that by Jan. 1, 2024, variants of its least expensive model — the Model 3 — will no longer qualify for the full $7,500 federal tax credit. Both the Model 3 Rear-Wheel Drive and Model 3 Long Range will not be eligible, and deliveries to customers must take place by Dec. 31, 2023, to qualify for the full tax credit, according to the company's website.

TechCrunch has reported that the tax credit will drop in half for deliveries of the two variants of Model 3 in the new year, though this was not specified on the Tesla page as of mid-December.

The 2023 guidelines on clean vehicle requirements under the Inflation Reduction Act (IRA) state that vehicles eligible for the credit must have 50% of their battery components manufactured or assembled in North America.

In addition, 40% of critical minerals in the batteries have to come from the United States, a country that has a free-trade agreement with the U.S., or be recycled in North America, according to the U.S. Department of Treasury.

While Tesla's Model 3 met these sourcing mandates, the percentages required are set to increase in 2024. Also, there is updated guidance from the Treasury Department on IRA laws. On Dec. 1, the Treasury announced new rules involving "foreign entities of concern (FEOCs)."

"To strengthen the security of America's supply chains, beginning in 2024, an eligible clean vehicle may not contain any battery components that are manufactured or assembled by a FEOC, and, beginning in 2025, an eligible clean vehicle may not contain any critical minerals that were extracted, processed, or recycled by a FEOC," the press release stated.

The U.S. Department of Energy (DOE) released proposed guidance to explain the definition of a FEOC, stating it includes any entities "owned by, controlled by, or subject to the jurisdiction or direction of a government of a foreign country that is a covered nation."

In a separate document, the DOE listed China, Russia, North Korea, and Iran as covered nations. Companies with at least a 25% voting interest, board seats, or equity interests held by governments of a covered nation would also be classified as FEOCs.

These new regulations aim to make American supply chains more resilient, increase well-paying EV manufacturing jobs in the U.S., and reduce reliance on foreign countries for materials.

Ars Technica reports that "Tesla is not forthcoming on its site about the reason for losing the tax credit for [the] Model 3 variants."

To sum things up, it looks like most of Tesla's cheapest Model 3 cars won't meet the new battery component and minerals standards under the IRA. That means that for customers who qualify for the tax credit, the rear-wheel-drive Model 3 will now cost roughly $35,240 instead of $31,490 (base price after credit), as TechCrunch reported.

Customers who take delivery of qualified Model 3 vehicles through Dec. 31 and meet all federal requirements will still receive the full $7,500 tax credit.

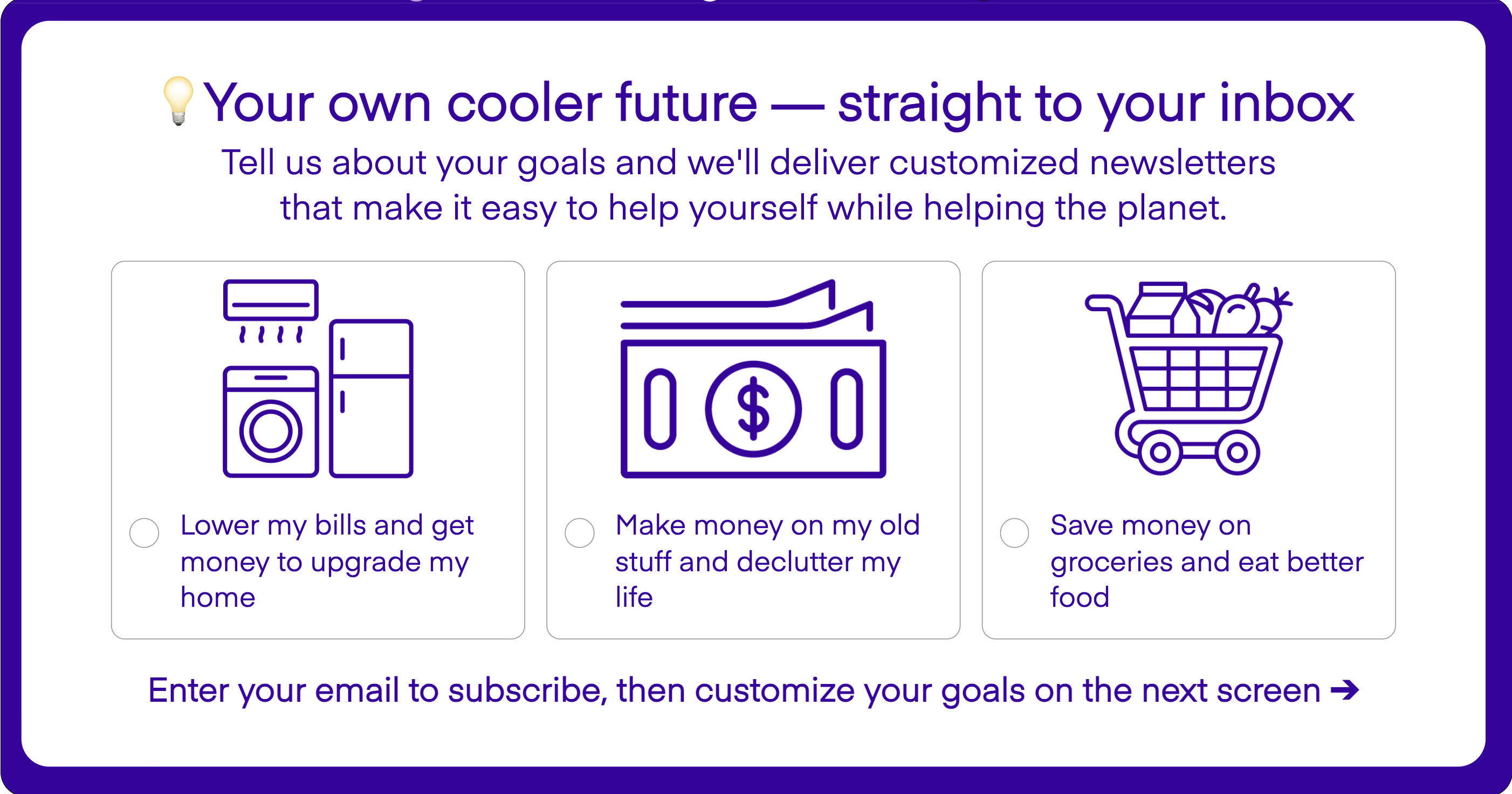

Join our free newsletter for cool news and actionable info that makes it easy to help yourself while helping the planet.