State Farm, California's largest insurance provider, announced it would not renew insurance policies for approximately 72,000 homes and apartments in the state beginning this summer.

What's happening?

In March, State Farm stated that it would discontinue coverage for around 30,000 homes and 42,000 apartments, citing surging costs, increasing risks of disasters such as wildfires, and outdated insurance rules as reasons for terminating the policies, per the Associated Press.

The insurance company said the policy expirations would "occur on a rolling basis" through 2025, starting July 3 for homeowner, rental dwelling, and business owner policies and Aug. 20 for commercial apartment policies.

"This decision was not made lightly and only after careful analysis of State Farm General's financial health, which continues to be impacted by inflation, catastrophe exposure, reinsurance costs, and the limitations of working within decades-old insurance regulations," the company said in a statement.

"State Farm General takes seriously our responsibility to maintain adequate claims-paying capacity for our customers and to comply with applicable financial solvency laws. It is necessary to take these actions now."

Per the AP, the move came nine months after State Farm announced it would no longer issue new business and personal property and casualty insurance policies in California. In other words, the company no longer thinks it can find a way to be profitable in the state.

Watch now: Alex Honnold test drives his new Rivian

Why are the coverage cancellations concerning?

When home or apartment owners are dropped from their insurance coverage, they have to scramble to find a new policy, which could be more expensive or not cover all their needs.

While property owners in California who are facing non-renewal can buy a Fair Access to Insurance Requirements plan — a state-run private insurance program that offers policies to high-risk customers — the "last-resort coverage" is usually more expensive and provides minimal coverage compared to standard policies, per the Orange County Register.

However, with more insurance companies pulling out of the California market or limiting coverage recently due largely to the elevated risks of natural disasters, some homeowners may have no other option. The Register stated that FAIR plan policy counts have doubled in the last five years.

Because of the increasing threat of natural disasters caused by our overheating planet, insurance companies in other vulnerable states, such as Florida, are also discontinuing coverage. In the last year, four insurance companies in the state closed their doors to new and existing customers.

TCD Picks » Quince Spotlight

Many private insurance companies in disaster-prone states are increasing premiums to offset the risks of extreme weather, which makes owning a home even more difficult since the cost of living is already high.

What's being done to help?

According to the AP, California's elected insurance commissioner is reforming the state's home insurance regulations to restabilize the market.

"Changes to outdated regulations will improve choices for all Californians so everyone has options beyond the FAIR Plan," deputy commissioner Michael Soller told the Register.

We can help homeowners in high-risk areas by switching to electric appliances, powering our homes with solar energy, and making sustainable choices when we shop. Even one small change, multiplied by thousands of people, can help curb the pollution driving more extreme weather.

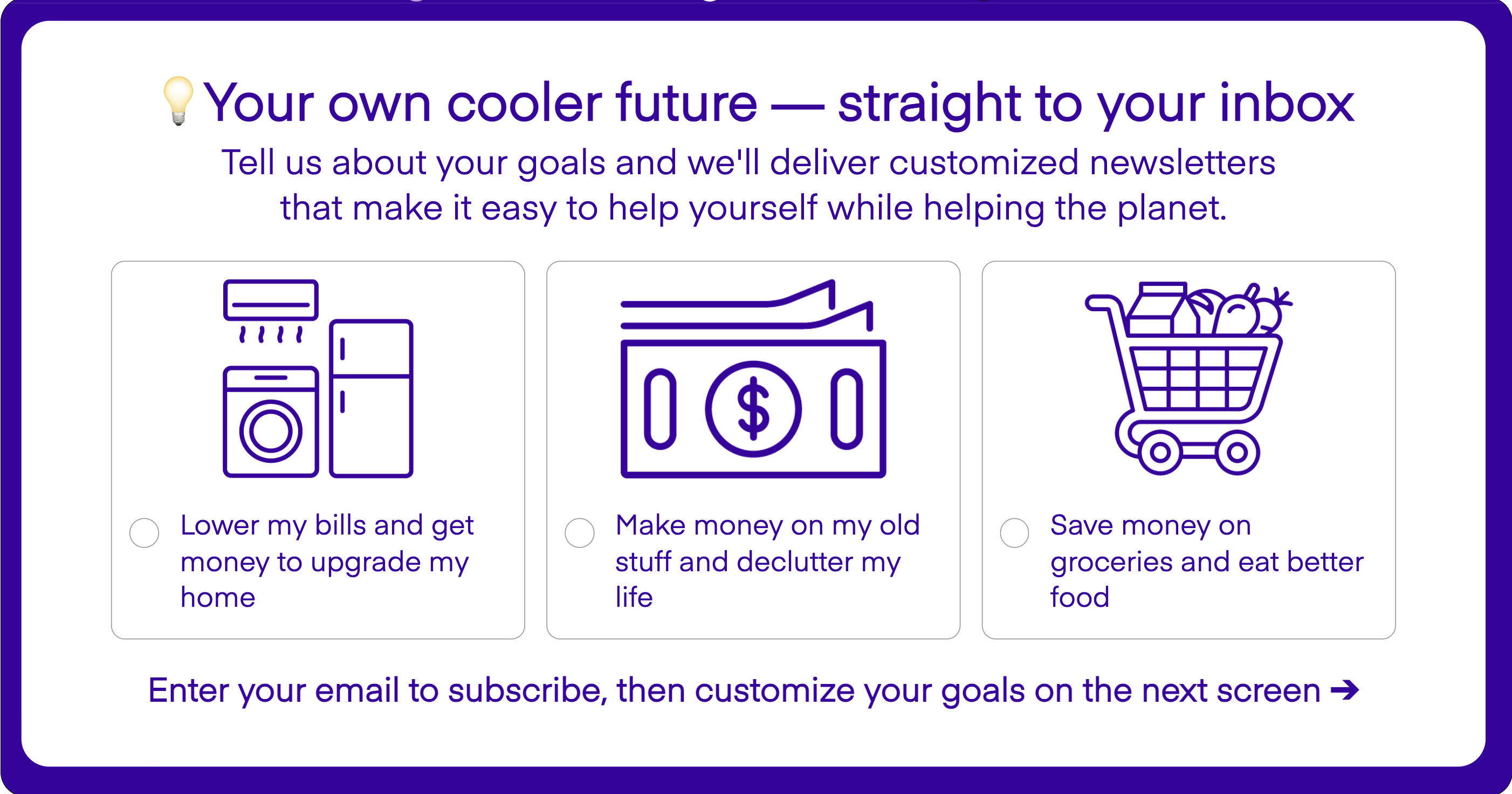

Join our free newsletter for cool news and actionable info that makes it easy to help yourself while helping the planet.