The ongoing climate crisis has increased the frequency and intensity of natural disasters like the recent Hurricane Helene and Hurricane Milton, and insurance companies are pulling back coverage from the states facing the biggest threats.

What's happening?

As reported by the Monterey Herald last month, a filing submitted to the California Department of Insurance revealed that State Farm projects the number of home insurance policies issued in California to decline by 1 million over the next five years from 3.1 million at the end of 2023 to 2 million by the end of 2028.

The insurance giant ceased writing new homeowners policies in the Golden State since May 2023 due to wildfire risk and increased construction costs causing financial distress for the company.

On top of that, State Farm is also asking the California Department of Insurance to improve a plan that would hike rates by 30% across the state, which would follow a 20% increase that came in March. The company claims that this is an effort to be protected from insolvency, further illustrating the burden it has faced after years of climate change.

Why is this important?

According to the Monterey Herald, State Farm is the biggest home insurer in the state of California, with one in five homes being covered by the company. State Farm informed 72,000 policyholders this year that it would not renew their coverage starting in July, but the company said to the Monterey Herald that the non-renewal figure represents just over 2% of the company's policy count in the state.

Unfortunately, this situation is not unique, as the threat of extreme weather events has made it challenging for insurers to manage the financial risks associated with these disasters. The Monterey Herald noted that Allstate received approval from state regulators in August for a bid to increase rates by an average of 34%, a move that affects 350,000 homeowners — that number includes 70,000 in the Bay Area.

California residents aren't alone in facing these challenges, as multiple brand-name insurance companies have pulled their coverage out of states like Florida and Louisiana because of the threat of hurricanes.

These situations leave homeowners with no choice but to resort to state-run insurance options that are usually more costly.

What's being done about this?

The Monterey Herald noted that Consumer Watchdog called the rate hike from State Farm a "$5.2 billion bailout by policyholders over the next four years" and filed a petition to stop it. However, the process was described as "ongoing with no timeline for when it could be resolved."

The number of policyholders on the state-run FAIR plan has grown by more than 20% over the last year alone to in excess of 350,000, per the Monterey Herald. However, the plan's liability exposure skyrocketed to a whopping $336 billion as of February 2024, stoking fears that a single devastating wildfire could overwhelm the available resources.

Amy Bach, executive director of insurance consumer advocacy group United Policyholders, offered some optimism that reforms proposed by the State Department of Insurance can change these projections.

"The insurance commissioner has said that in 2025, he expects the market to open back up and that we'll see many more insurers willing to write more policies in the new year," Bach told the Monterey Herald. "So we can see this as more bad news in 2024 and hope that 2025 will be better."

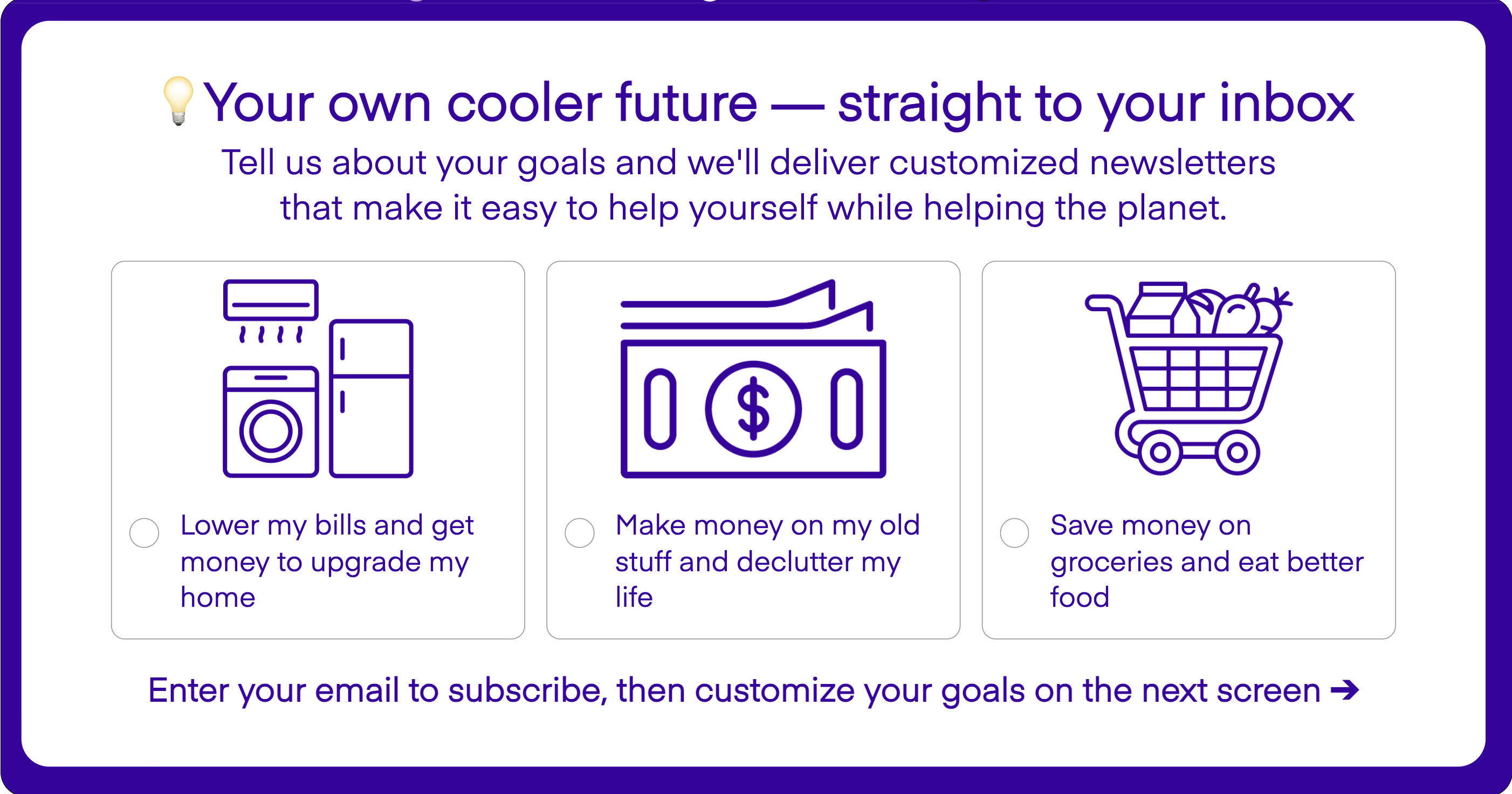

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.