Home insurance woes are not a problem that's unique to New Mexico — but that doesn't make them any less concerning.

With increasingly severe wildfires putting homes at risk in the state, insurers are raising costs or dropping coverage entirely, putting homeowners at risk of losing coverage entirely.

What's happening?

A recent meeting of the state's Legislative Finance Committee examined the causes of the growing issue, Source New Mexico reported.

There, the Office of the Superintendent of Insurance cited increases in insurance premiums over the last three years. On average, all premiums in New Mexico increased by 16%, but in particularly fire-prone counties, the numbers were between 41% and 47%.

While nobody wants to pay steep premiums, it's preferable to not having any coverage available — but that's the reality for many, who are losing the ability to purchase or renew coverage as major insurers balk at the fire risk.

According to Source NM, regulators' "hands are tied when it comes to cracking down on insurance companies who refuse to offer policies." Given that, many officials feel that all they can do is work to reduce wildfire risks.

Rep. Harlan Vincent lamented the predicament in which his constituents find themselves. "What do we do with our New Mexicans, especially in an area that's been devastated, that want to come home, that want to rebuild?" he said.

Why is this concerning?

The rise in more intense wildfires has been correlated with global heating, which means that as temperatures keep rising, fires will become even harder to control.

This will come with unwanted ripple effects, Source NM explained. That includes "killing jobs for realtors and homebuilders, harming economic development, and making home ownership extremely difficult for entire communities."

Other parts of the U.S. and the world are already feeling the pressure. California is in a record-setting fire season, as is Oregon; Utah residents are facing similar insurance crises.

What's being done about this?

While the best way to mitigate these threats is to reduce planet-warming emissions, much of that burden falls on larger government bodies and corporations.

In the meantime, states like New Mexico are looking for practical ways to protect their residents. That includes offering state-backed insurance, known as the Fair Access to Insurance Requirements plan, but as Source NM explained, that is a "last resort with minimal coverage." However, an OSI representative did say they were working on being "creative" with updating these plans to make them more viable.

In tandem, officials are looking at ways to minimize fire-damage risks, including creating defensible space around houses and adopting risk-reduction community initiatives such as education and emergency volunteer recruitment.

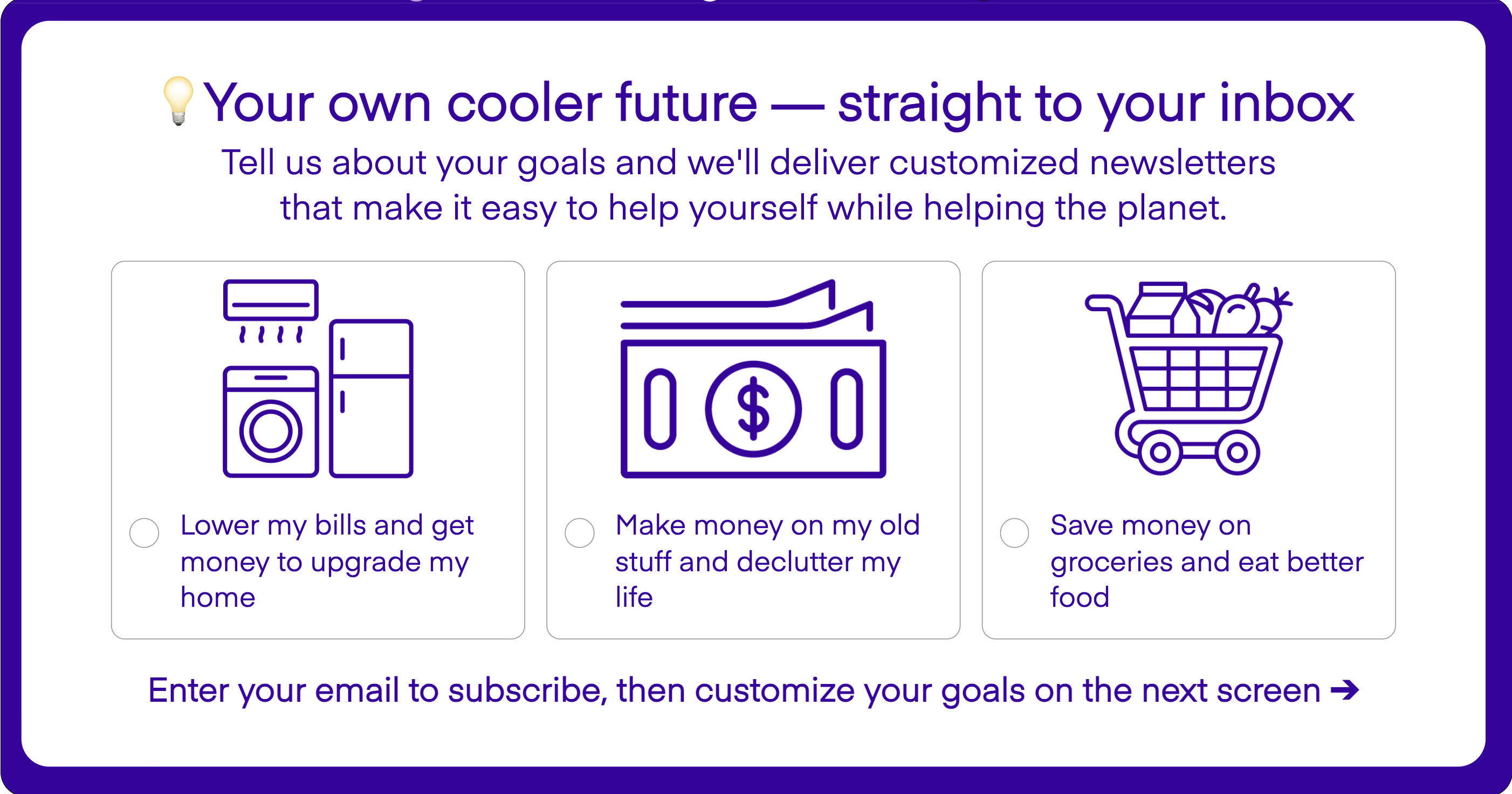

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.