U.S. investment bank Morgan Stanley sees big things ahead for the carbon credit market, which it predicts will balloon from $2 billion in 2022 to $100 billion by 2030, Carbon Units reported. The rebound is expected to start after 2025.

What are carbon credits?

Carbon credits, or carbon offsets, are investments in green projects that are designed to reduce the amount of carbon pollution in the air. In theory, these projects remove carbon dioxide or keep it from being produced, helping to cool down an overheating planet. Companies buy carbon credits to invest in these projects and try to cancel out their pollution.

In practice, some carbon offsets are more effective than others, and certain projects have come under fire for being ineffective and giving companies excuses to pollute. For example, if a project "protects" forest that wasn't likely to be cut down anyway, is it actually making a difference to the world's carbon pollution, and is it truly equipped to ensure victory if that land is targeted?

But other carbon offset projects do vital conservation work, plant new trees, or delve into new technology for removing carbon from the atmosphere, and that is incredibly valuable in a world where heat-trapping pollution has gotten out of control.

Why is Morgan Stanley betting on carbon credits?

In making its new report about the expected carbon offset market boom, Morgan Stanley pointed to many regulators and powerful institutions laying the groundwork for that growth, Carbon Units revealed.

For example, multiple high-ranking U.S. officials have made an announcement backing the carbon credit market.

That's good, because our society is still producing a lot of pollution that is heating up the planet. Activities that remove carbon and cool the Earth down are vital for our future — plus, they help companies maintain a green image and attract eco-savvy customers.

Morgan Stanley's advice for investors

In a recent guide, Morgan Stanley provided several guidelines for carbon credit buyers, Carbon Units reported. Rather than worrying about their value, investors should think about how to make their purchases effective.

That means diversifying your portfolio; including plans that are all about carbon capture without other benefits to the buyer; avoiding delays and acting now; and choosing carbon offsets that take effect immediately instead of ones that will only pay off in the future.

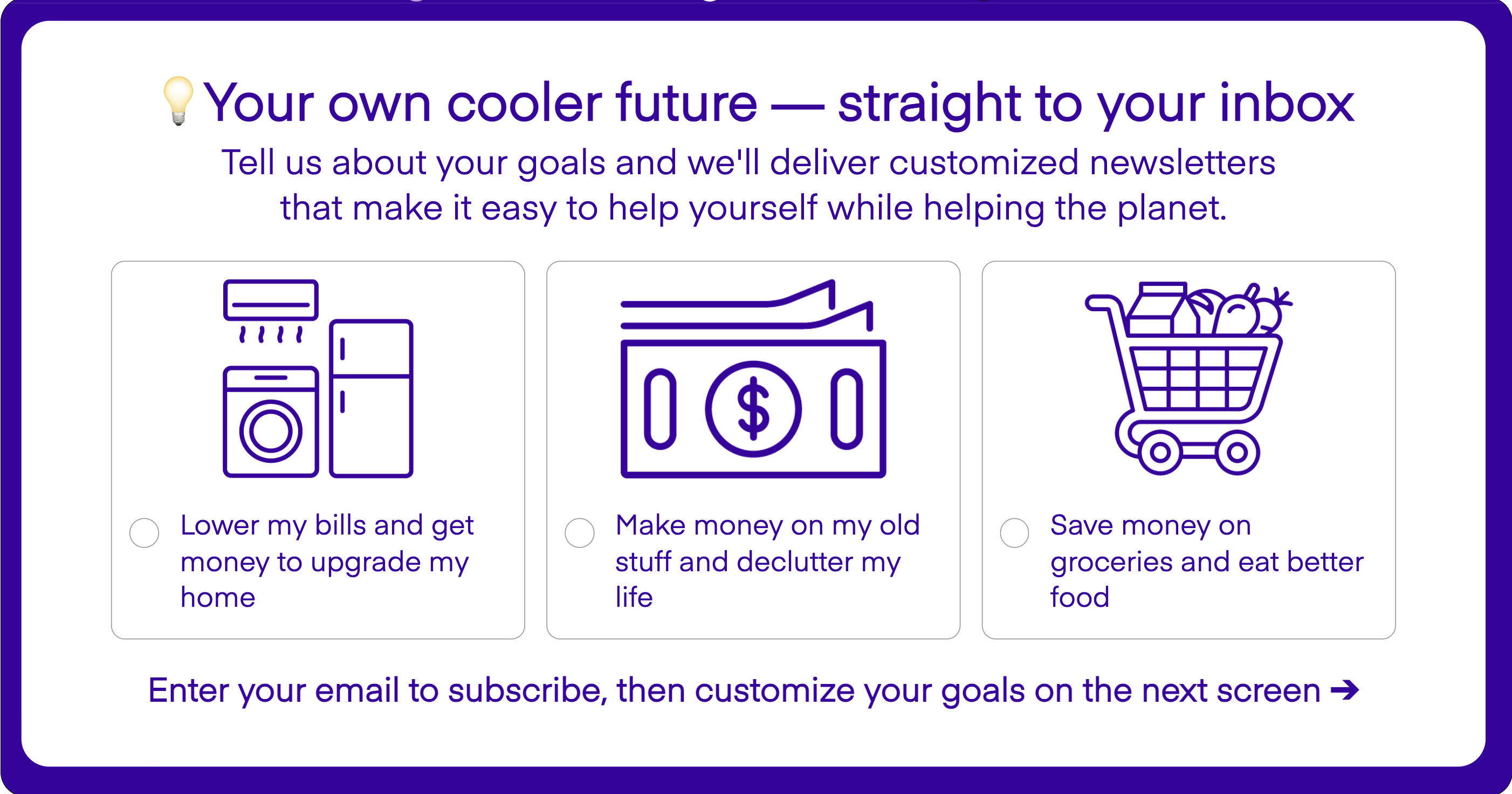

Join our free newsletter for cool news and actionable info that makes it easy to help yourself while helping the planet.