An insurance expert says no area of the country is immune to the impacts of a warming world. Due to the increased risk, the insurance industry has shifted to a "predict and prevent" strategy.

What's happening?

Through July, 19 confirmed weather and climate disasters have occurred in the United States, costing over $1 billion each. According to the National Centers for Environmental Information, this marks the second-highest number of billion-dollar events for the first seven months of the year behind 2023. Last year was a historic year for billion-dollar weather and climate disasters, totaling 28.

"The insurance industry is shifting to a 'predict and prevent' approach to risk management versus the prior approach of replacing and repairing properties following losses," said Mark Friedlander, director of corporate communications at the Insurance Information Institute, per an interview with bankrate.com. "Predicting and preventing losses leads to less volume of claims and less severe claims, generating better rates for all policyholders."

More and more insurance companies are shifting to this approach in response to our changing climate. Heat-trapping gases in our atmosphere continue to warm our planet to unprecedented levels. According to NCEI, July was Earth's 14th consecutive month with record warmth.

Why is the impact of a warming world on insurance costs important?

Increased risks from extreme weather events are one of the driving forces behind a spike in insurance premiums. Realtor Magazine says the average homeowners insurance rate in May was $2,377 annually, but they expected a 6% jump in the average premium by year's end.

Some states will be hit much harder than others. According to an Insurify report, Louisiana's projected increase this year is 23%, and Maine's is expected to jump by 19% in 2024.

Soaring rates mean many people struggle to find insurance to cover their homes. Insurance companies in some states have abandoned at-risk homeowners because of rising costs.

Friedlander says 90% of the country's natural disasters involve flooding, but less than 10% of homeowners carry flood insurance from a private flood insurer or a federally supported National Flood Insurance Program.

What's being done about protecting homeowners from disasters?

Friedlander's suggestions for homeowners looking for protection include being aware of your area's various risk factors, knowing what your insurance policy actually covers or doesn't cover, fortifying your home, and shopping around often to be sure you aren't paying too much for coverage.

Reducing the pollution from greenhouse gases into our atmosphere that are overheating our planet is essential. Small steps like upgrading to electric yard tools or using a reel mower can help. Community solar programs are another way to reduce your pollution footprint by tapping into a clean energy source.

TCD Picks » Quince Spotlight

💡These best-sellers from Quince deliver affordable, sustainable luxury for all

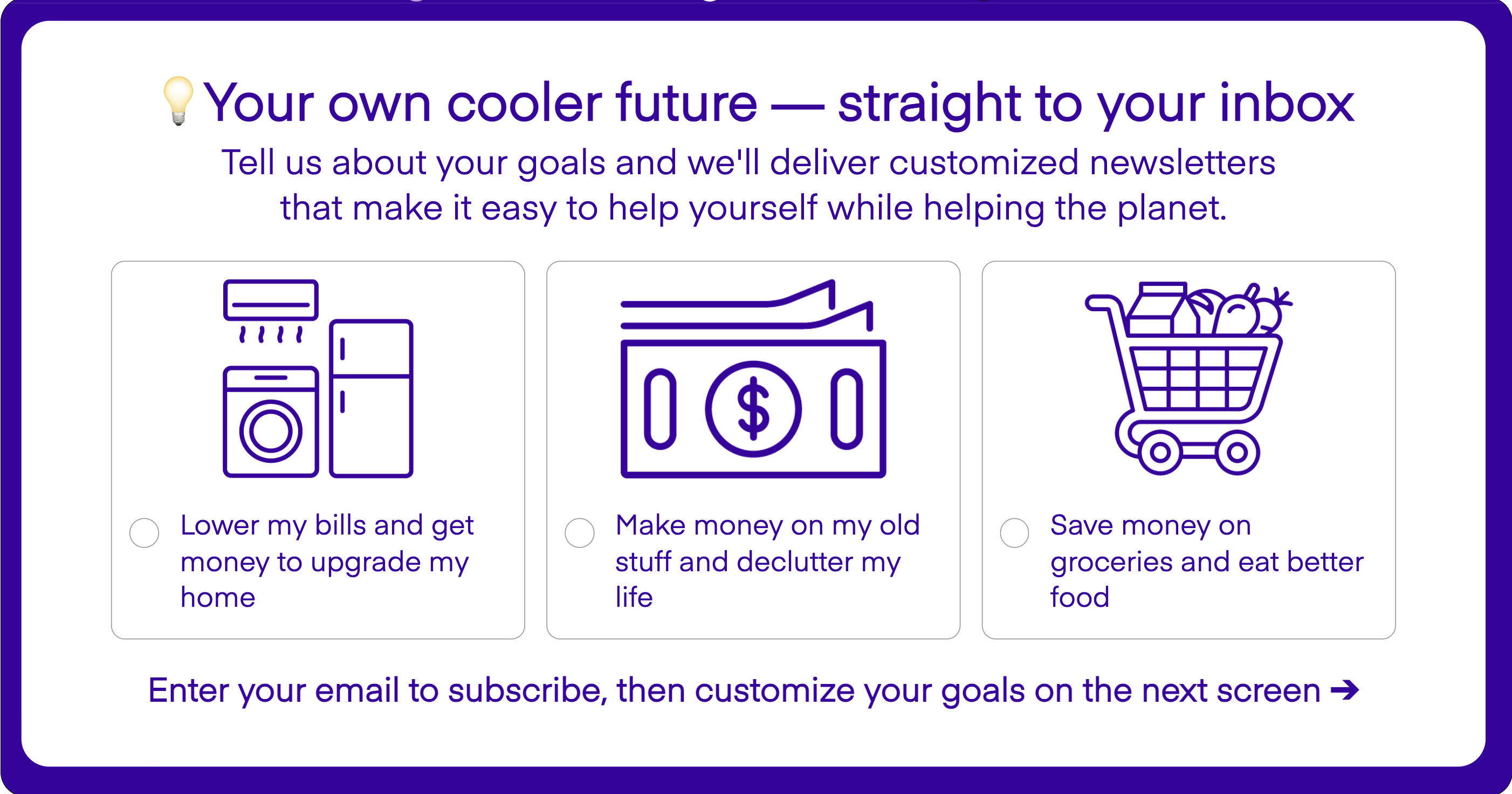

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.