A devastating wildfire leveled the Daneau family's California home in 2018. The only thing that allowed them to rebuild their lives was the payout from their home insurance.

But they were uninsured when a second wildfire swept their area earlier this summer — causing them to lose everything again, this time without a safety net.

What happened?

California's Park Fire destroyed over 400,000 acres and 600 structures in July as fire response teams worked for over a month to contain it, according to Cal Fire.

One of the destroyed structures was the house the Daneaus had bought using their insurance payout after their first home burned down in 2018. But this time, the Guardian reported, they had been denied coverage by private insurers. After being forced to join the state-sponsored last resort Fair Plan, they'd dropped it after premiums soared to the tens of thousands. Now, they're left without a home and without any hope of a payout.

"We had never intended on living in a house without insurance, especially given the fact that we knew how important it was. That's what saved us from complete devastation," Michael told the Guardian.

"Now we are left with nothing. It's like we are having to start over again."

Why is this pattern concerning?

With global temperatures rising, there's been a documented increase in extreme wildfires. The same issue is playing out in coastal cities, where sea level rise and increased precipitation have worsened the effects of tropical storms.

Home insurers are increasing rates for their coverage in these zones, where thousands of structures can be leveled overnight. But with regulatory limits on how quickly they can raise rates, many companies have been forced to pull out of states altogether. And homeowners like the Daneaus are finding themselves one disaster away from devastation.

What's being done?

With state-sponsored basic plans as the only option for many, the insurance commissioner in California has proposed "major reforms" to make them sustainable, the Guardian reported. These include allowing private companies to raise rates quickly and set prices using catastrophe models so that more homeowners can retain coverage.

Communities are also working to educate and help people act to prevent disaster, such as partaking in prescribed burns.

The Guardian quoted Taylor Nilsson with the Butte County Fire Safe Council, who said, "It reinvigorates us while we're feeling the grief and the sadness of what we've lost, [and] emphasizes the importance of what we do working with partners to make sure that this work happens."

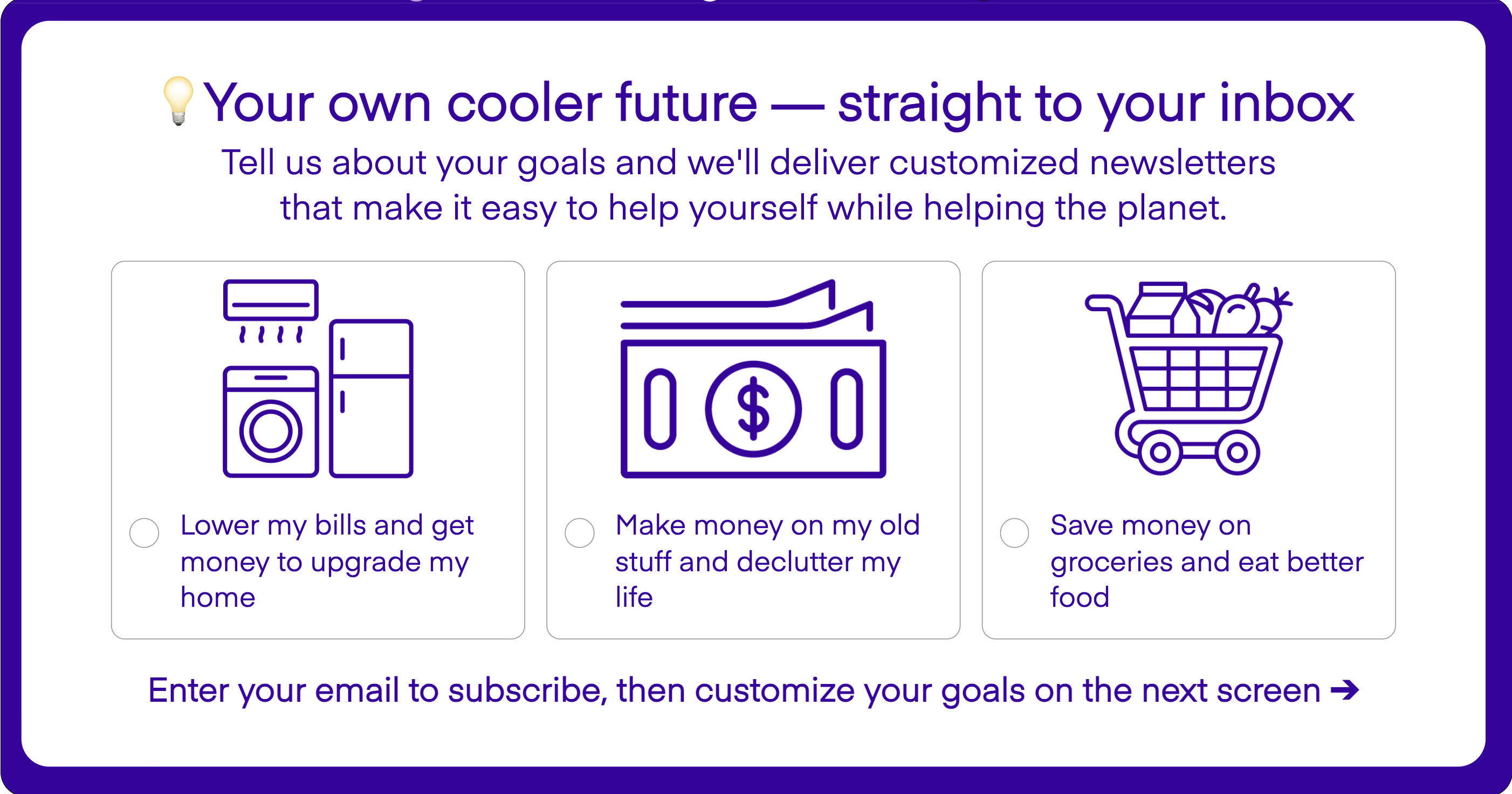

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.