The Biden administration's Inflation Reduction Act came with incredible savings for homeowners. Taxpayers claimed over $8 billion in incentives for climate-friendly home upgrades, The Washington Post reports.

The IRA has many facets, including tax credits and rebates. The nonpartisan congressional Joint Committee on Taxation estimated they would total $2.4 billion in the first year, rising to $4 billion per year for the next two years.

People across the U.S. have started adopting energy-efficient technology much faster than anticipated, according to the Post. Most states saw 2% to 3% of households claim these incentives, with Maine, New Hampshire, and Vermont topping the charts at 4% and only Oklahoma and West Virginia falling below 2%.

Rebates and tax credits were available for a range of energy-efficient upgrades. For example, one tax credit was designed to cover 30% of the cost of solar panels and batteries. The average household that installed this equipment and claimed the credit got $5,000 back, for a total of $6 billion nationwide, and that was just one of the available credits. Homeowners could also get incentives for installing heat pumps, adding insulating windows, and improving the home's insulation in other areas.

"The reality is, the American people want to adopt solar panels, heat pumps, and electric vehicles, and the federal Inflation Reduction Act is helping them do it," said Leah Stokes, a political scientist from the University of California at Santa Barbara, per the Post.

All of these upgrades are great for both homeowners and the environment. According to the Post, a typical household that gets solar panels saves $2,000 on energy each year, and heat pump users save up to $3,000 per year.

Meanwhile, the more gas and propane heating are switched out for electric, and the more dirty energy from the grid is traded for solar, the less pollution enters the atmosphere.

According to Stokes, one of the main reasons taxpayers claimed more incentives than expected may have been that states also created their own incentives, sweetening the deal for buyers, the Post reveals.

"We've seen a yo-yo up and down in the past suggesting that these tax credits do have a stimulating effect on the market," said Sara Baldwin, lead researcher on decarbonization at Energy Innovation, per the Post.

In other words, tax credits are leading to more adoption of money-saving and energy-efficient technology — and that's encouraging news.

If you want to take advantage of these tax incentives yourself, one of the best first steps is to check in with the nonprofit Rewiring America. This group's free tools will help you find providers, compare options, and access your government incentives for your project.

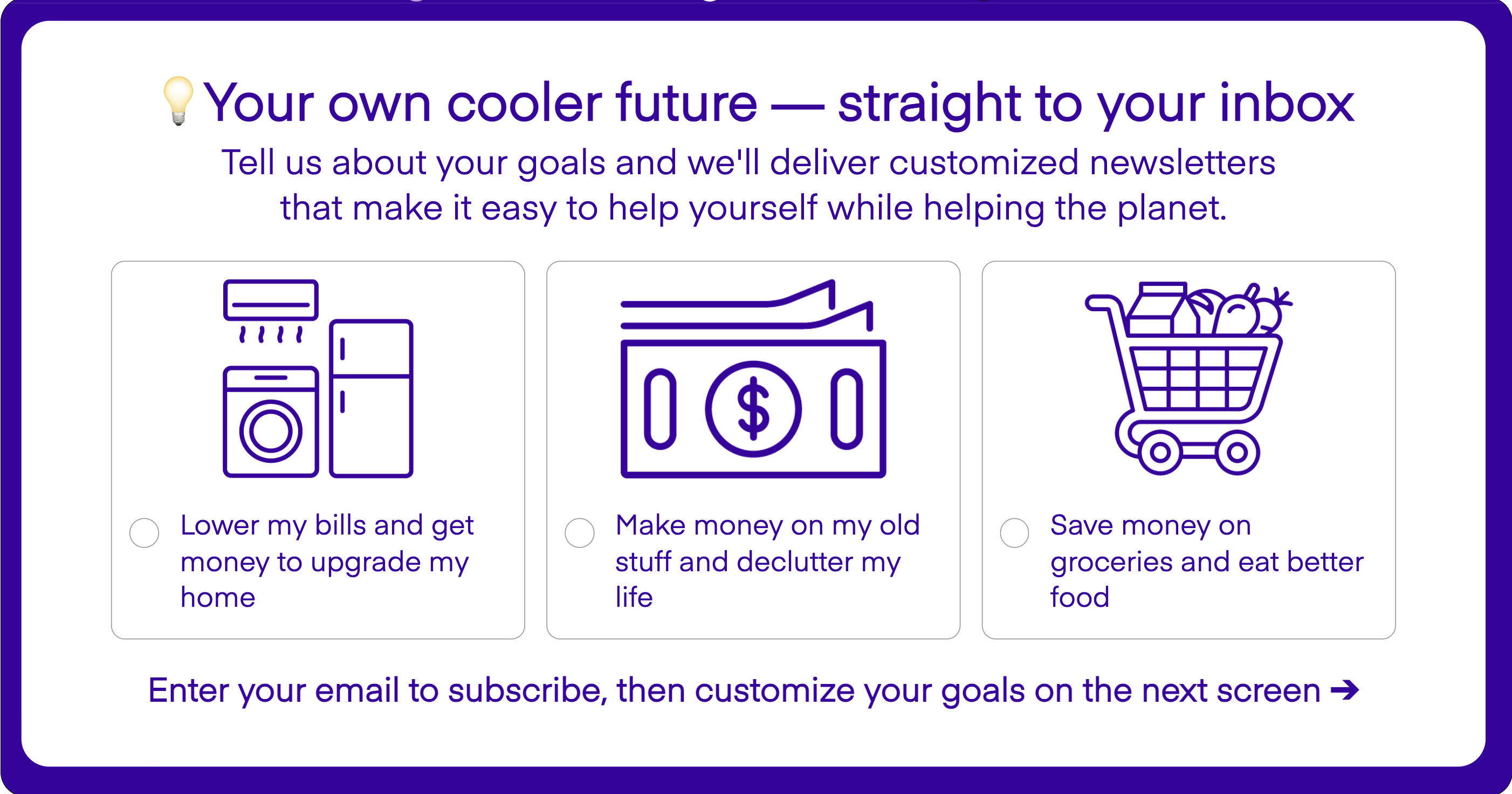

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.