Your home renovation era has arrived, now that the U.S. government is giving people money to modernize their spaces and cut down their energy bills.

Sounds too magical to be true? It's not a dream — just the Inflation Reduction Act, a 2022 law designed to protect your health, safeguard your property, prevent natural disasters, and improve your finances.

Just two years old, the IRA is the nation's largest investment ever in tackling the toxic environmental pollution responsible for extreme heat, record flooding, increased illness risk, infrastructure damage, and more. Reduce dirty energy's harmful pollution and add to your bank account by prioritizing key cost-cutting renovations that also align with the IRA's tax credits and available rebates.

For example, ditch your unhealthy gas stove and go for a cleaner and more convenient induction cooktop. Minimize your reliance on an outage-prone power grid by installing rooftop solar panels. Want rewards that just keep giving? Upgrade to a heat pump water heater to enjoy massive savings on annual utility bills.

Additional home upgrade options include leveling up appliances (go ahead, lose the clunky clothes dryer) and exploring energy-efficient system replacements for insulation, air conditioning, and ventilation. Headed out the door? Through the IRA, anyone who purchases a new or used electric vehicle can score tax breaks — up to $7,500 and $4,000, respectively.

According to the U.S. Department of Energy's website, "all households are potentially eligible" for the Home Efficiency Rebates program designed to offer rebates up to $4,000 for improvements that cut household energy use by at least 20% and up to $8,000 for those achieving a 35% or higher reduction. Residents of Wisconsin can take advantage of these home rebates now, with more than 20 other states moving through the program's application pipeline.

The Home Efficiency Rebates program is separate from the Home Electrification and Appliance Rebates program specified for low- and moderate-income households. These rebate programs are also distinct from federal tax credits that are already available.

Such qualified improvements to your house, car, and appliances make a huge difference in reducing expenses, helping your health, and ensuring a less-polluted environment in the short and long term. And the IRA has made taking these sustainable steps easier than ever. The nonprofit Rewiring America simplifies it even further with free tools to guide you through the process of selecting applicable tax credits, matching with contractors for energy-saving improvements, and maximizing your budget.

The IRA joins a slew of other recent climate-focused policies and programs across the U.S. — like those targeting a cleaner water supply, recycling in retail, and accountability for dirty energy production — working to protect our land, resources, children, air quality, bank accounts, and daily lifestyles.

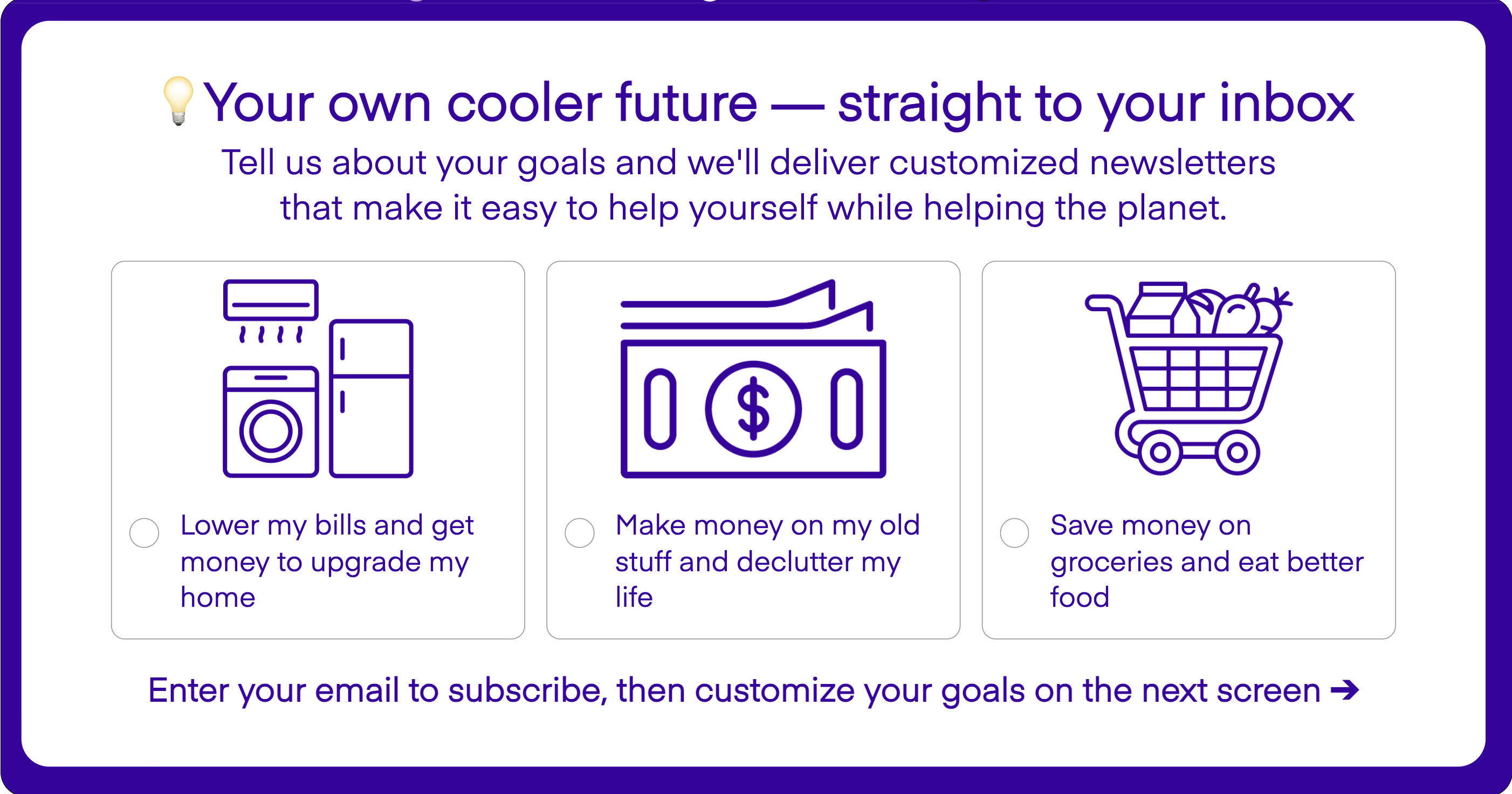

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.