Being a homeowner in 2023 is already challenging, from a high cost of living to a lack of affordable housing in the real estate market. But thanks to extreme weather events, owning (and insuring) a home is becoming even more expensive.

When an individual purchases insurance, the company bets on the idea that it will make more money off the deal than it will pay out. But in an unstable climate in which severe weather events are becoming more and more common, insurance companies are in a losing battle. To offset the costs, the companies raise the premiums, meaning that homeowners will pay more for policies than ever before.

A set of maps created by Axios with data from a First Street Foundation study reveals that about 12 million properties across the country should expect possibly higher insurance premiums because of flooding, 24 million because of possible wind damage, and about 4.4 million because of wildfire risk. Areas with the most flood, wildfire, and wind risk are expected to see the highest bumps — including vulnerable states like the Carolinas, Florida, Louisiana, Texas, and California.

About 12 million properties may see premium hikes because of the risk of flooding, nearly 24 million because of potential wind damage, and about 4.4 million because of wildfire risk, per estimates from the First Street Foundation, a climate data nonprofit. https://t.co/Jn8JB3JFqf

— Axios (@axios) October 1, 2023

About 640,000 of these price hikes are expected to impact those with delinquent mortgages, increasing the risk of default.

Many insurance companies across the United States have announced that they will be increasing their rates — or backing out of insuring policyholders altogether because of the higher risk proposed by climate change.

Farmers Insurance joined three other insurance companies in announcing that it will not offer policies to residents living in Florida as of July 2023. Similarly, State Farm announced it would not cover new policyholders in California, which has made it more difficult for homeowners to find insurance — let alone affordable policies.

However, the rate hikes (and impending danger of human-caused weather events) have not discouraged some from flocking to disaster-prone areas; Redfin reported a 103% increase in immigration to these areas between 2019 and 2020, as Bloomberg reported.

Some states have instituted policies to cap rate hikes to stop insurance hikes. The California state law, for example, forbids private insurance companies from raising rates more than 7% annually — but public insurance companies do not share the same standard.

California also announced that it will allow companies to factor climate risks into policy prices, which was made to prevent companies from leaving the state. However, there is very little protection for homeowners on these price hikes otherwise.

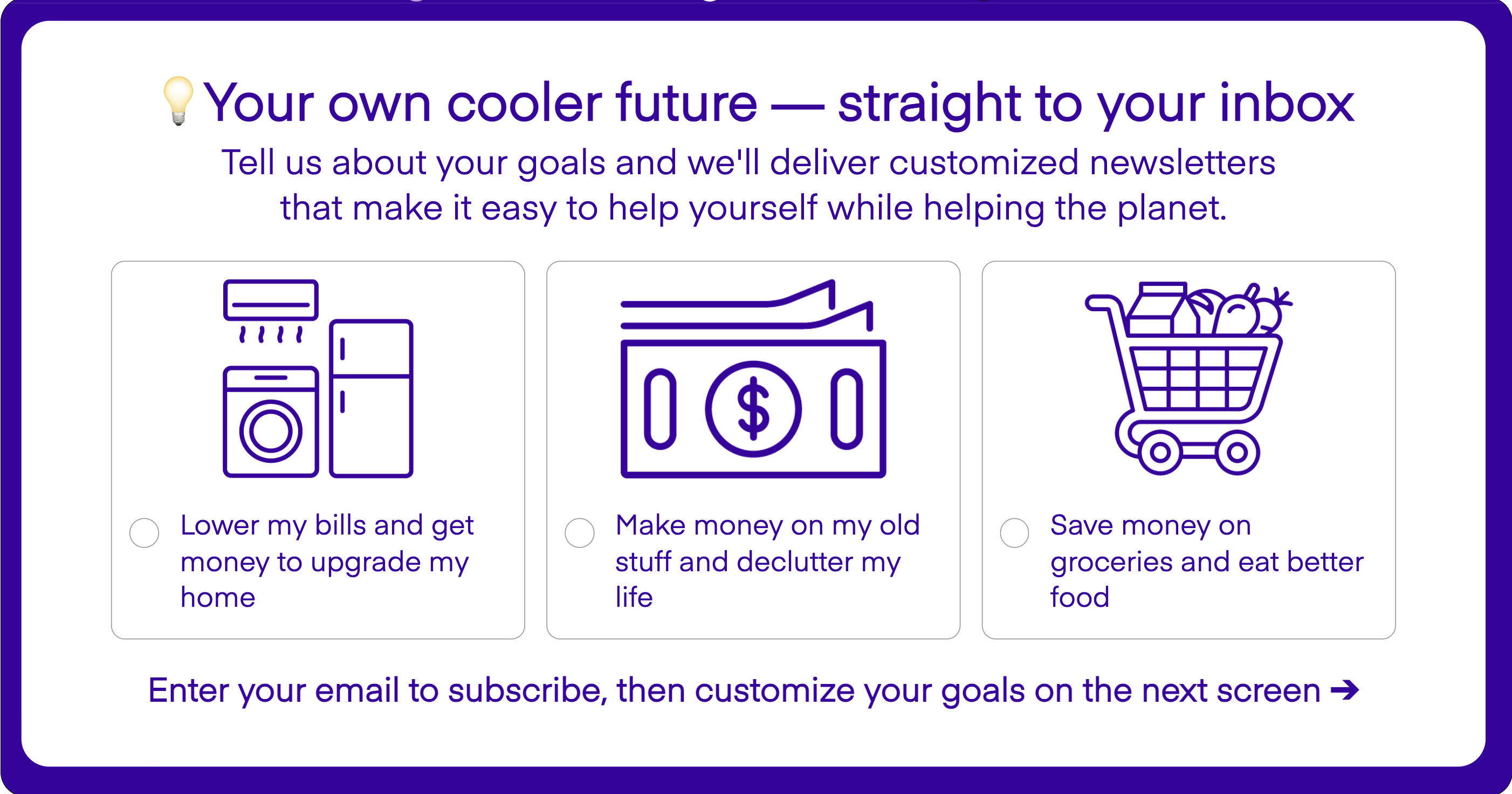

Join our free newsletter for cool news and actionable info that makes it easy to help yourself while helping the planet.