Home insurance rates are going through the roof, and experts believe the trend will continue, with severe weather a significant contributing factor.

What's happening?

Policygenius found that insurance rates at time of renewal rose, on average, 21% from May 2022 to May 2023, CNBC reported, noting "the rate of price increases is not expected to slow."

It stated that increasingly common severe weather events are making the cost of doing business higher for insurance companies, which pass on those expenses to consumers.

The details are scarce, as CNBC said insurers don't share data about premiums and risks. The upward trajectory is not new, however, and it's not uniform. From 2012 to 2021, the average home insurance premium rose by $377 — to $1,411 — about a 36.5% jump.

"The levels of risk and the kinds of hazards that a property can be exposed to are massively changing," said Carlos Martín, director of the Remodeling Futures Program at Harvard University's Joint Center for Housing Studies, per the CNBC report.

"And right now, there's a lot of confusion — not just among the homeowners, but also among the insurers about how they should be pricing this actuarially."

Why is this important?

Extreme weather events are indeed happening more frequently, and they are becoming more intense as well. This is driven by rising temperatures, mostly caused by humans' use of dirty energy sources such as coal, gas, and oil.

The production and burning of these fuels produces methane, carbon dioxide, and other gases — which enter the atmosphere, where they absorb the sun's heat, trap it, and keep it from reaching space. This spurs catastrophic droughts, floods, and wildfires, among other natural disasters.

As it relates to home insurance rates, California is on the front lines, as some major home insurance companies have recently stopped doing business there. But other states are experiencing the same problem, including seemingly low-risk states in Middle America.

Since most mortgages require insurance, as CNBC noted, homeowners have little recourse. Some have looked to move from the Gulf Coast or other flood-prone areas, but the West and other regions where the climate is conducive to wildfires are also feeling the insurance squeeze.

Others are stuck with their policies, watching their bills skyrocket. And state-backed alternatives "don't always provide the same quality of coverage that a private insurer might offer," CNBC pointed out.

What can we do to help lower home insurance rates?

One of the main contributors to rising insurance rates is our use of dirty energy, which overheats our planet and increases the frequency and severity of extreme weather events.

To move toward a sustainable future, you can invest in clean energy, which includes solar panels and community solar, as well as other electrified home upgrades such as an induction stove.

Making these changes will help reduce planet-warming pollution and can also save you hundreds on utility bills every year.

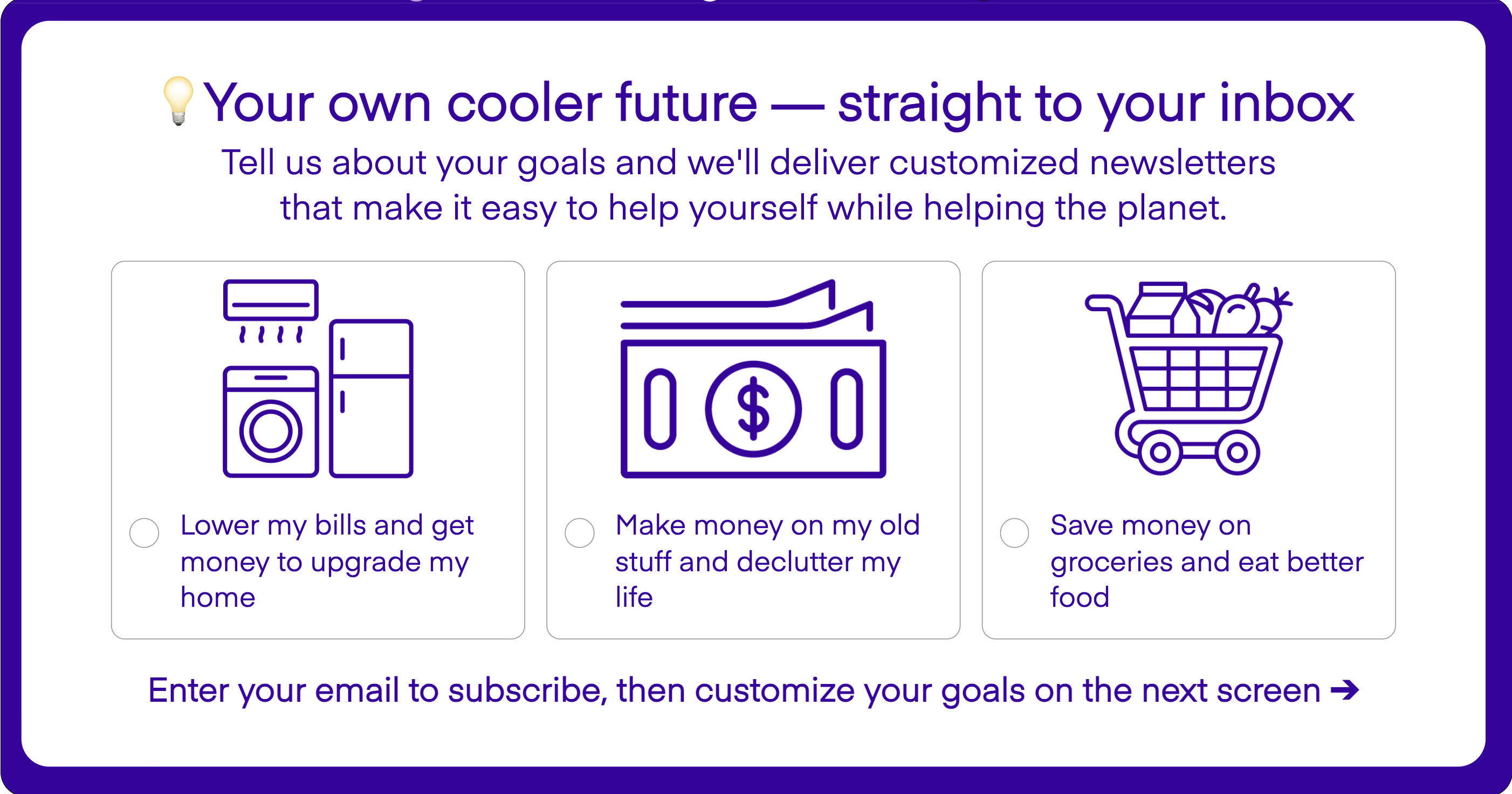

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.