As the overheating of our planet causes more frequent and more intense extreme weather events, insurance companies are facing more situations where they may have to actually pay out claims instead of just taking people's money and keeping it.

As a result, these companies are, in many cases, simply refusing to insure Americans who live in areas threatened by wildfire and other extreme weather events. The New York Times recently dived into the growing problem.

What's happening?

In theory, insurance works by pooling risk. Everyone pays money into a pool, and if disaster strikes one person (or several), they get to pull from that pool to pay for the damages.

For the actual insurance industry, which is concerned solely with the profits of shareholders, the math is a little different: You pay them money, they keep the money, and now they have more money than they did previously.

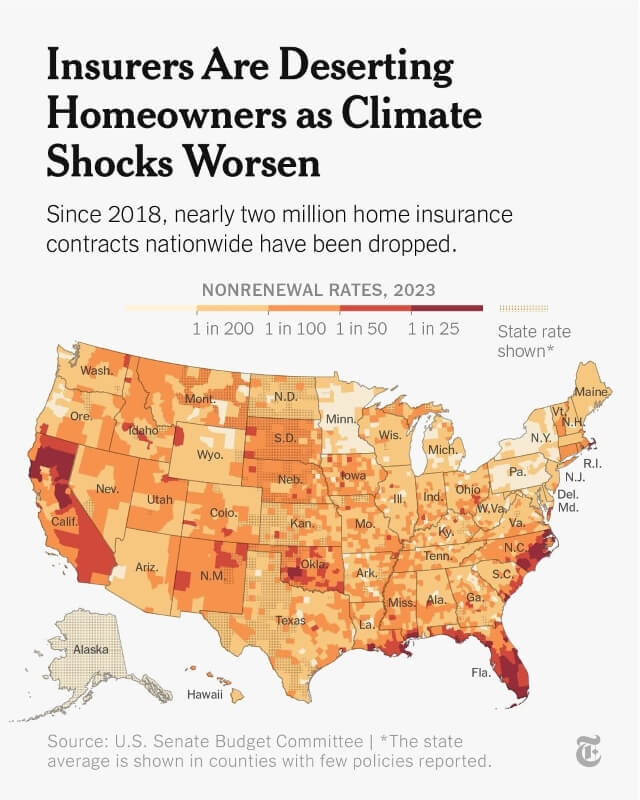

That means that in the areas where people most need insurance, companies like State Farm, Travelers, and others are simply refusing to provide coverage. Not only that, but they are taking coverage away from existing clients that they deem to be too big of a risk. The Times reported that more than 1.9 million home insurance contracts in the United States have been abruptly dropped since 2018. It put together an interactive map to show the seriousness of the problem, especially for coastal areas, in stark visuals.

Why is insurance important?

As the Times laid out, insurance is about more than having peace of mind in case of catastrophe (although it's certainly about that as well).

"Without insurance, you can't get a mortgage; without a mortgage, most Americans can't buy a home," reporter Christopher Flavelle wrote. "Communities that are deemed too dangerous to insure face the risk of falling property values, which means less tax revenue for schools, police, and other basic services. As insurers pull back, they can destabilize the communities left behind."

Throughout the country, we've been seeing reports of insurance premiums rising to fully unaffordable levels, essentially forcing people off their plans, or of people being denied coverage entirely. Younger homeowners have been especially impacted, with more than half of homeowners in the 18-34 age bracket having had their policies canceled between 2021 and 2024, according to one report.

What's being done about insurance companies?

Some states have state-run insurance programs for those deemed too risky for for-profit companies. However, those programs are often more expensive and offer less coverage.

🗣️ Do you think America is in a housing crisis?

🔘 Definitely 🙁

🔘 Not sure 🤷🏽♂️

🔘 No way 🏘️

🔘 Only in some cities 🏙️

🗳️ Click your choice to see results and speak your mind

Unfortunately, although more stringent regulations are likely needed in order to force the insurance industry to stick with riskier clients, things seem to be moving in the opposite direction. In Louisiana, lawmakers recently moved to deregulate the industry, allowing companies to pay out even fewer claims than they already do.

The one possible silver lining here is that at least information on how these companies operate is becoming more public, which could potentially lead to the type of public outcry that creates changes somewhere down the line.

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.