Since Congress passed the Inflation Reduction Act in 2022, energy-efficient home upgrades have become easier and more cost-effective than ever.

Depending on your location and income, you can save $14,000 through the Home Electrification and Appliance Rebates program, including a rebate of up to $1,600 for weatherization and insulation and up to $840 for an induction stove.

You could receive a rebate of up to $2,500 for updating your residential electric wiring. The HEAR program focuses on lower- and moderate-income families.

Separately, consumers could save up to $8,000 under the Home Efficiency Rebates program for eligible projects that reduce whole-home energy consumption by 20% or more. This rebate program will "potentially" be accessible to all households, per the U.S. Department of Energy. Like the HEAR program, it is still being rolled out in most states.

Electrifying your home, vehicle, and appliances is one of the best ways to lower your carbon footprint and decrease your monthly bills. For instance, average consumers can slash over $500 annually with a modern electric heat pump used for heating and cooling.

Most home heat pumps transfer heat between a house and the air outside and are called "air-source heat pumps."

A geothermal heat pump — which transfers heat to and from the ground nearby — offers remarkable savings. A device of this type is 50-70% more efficient than conventional heating and 20-40% more efficient at cooling than regular air conditioners, according to Smart Touch Energy.

The IRA was among the most critical laws for climate change mitigation, allocating $369 billion to fight global warming and transition to clean energy, including $8.8 billion for residential energy efficiency and electrification rebates.

Separate from the rebate programs, homeowners have already taken advantage of savings in the form of federal tax credits, with over 3.4 million U.S. households claiming $8 billion in residential clean energy credits on their 2023 taxes, according to the Treasury Department. For example, certain solar panels, a new heat pump, and an electric vehicle might result in a $20,000-plus tax break.

The widespread adoption of updated electric wiring and energy-efficient technologies continues to help the planet. By 2030, officials estimate a 40% decrease in U.S. pollution while bolstering disadvantaged communities through clean electrification. Meanwhile, some experts believe the IRA will prevent 100,000 asthma attacks annually in the same time frame.

🗣️ Should the government be paying us to upgrade our homes?

🔘 Definitely 💰

🔘 Depends on how much it costs 🫰

🔘 Depends on what it's for 🏡

🔘 No way 🙅

🗳️ Click your choice to see results and speak your mind

Consumers who want to save money while helping the planet can use free tools and resources from nonprofits like Rewiring America, whose free calculator tool helps you uncover your own potential tax credits for various projects.

So far, many consumers are happy with the IRA incentives. In response to a Reddit post about filing for home energy upgrade rebates, one Redditor said they "claimed the heat pump AC replacement credit successfully for the max, $2,000."

Kara Saul-Rinaldi, the CEO of an energy and environment strategy company, told CNBC: The IRA and rebate program tax breaks make "large, expensive purchases" of energy-efficient technologies and electrification "more accessible" to regular consumers.

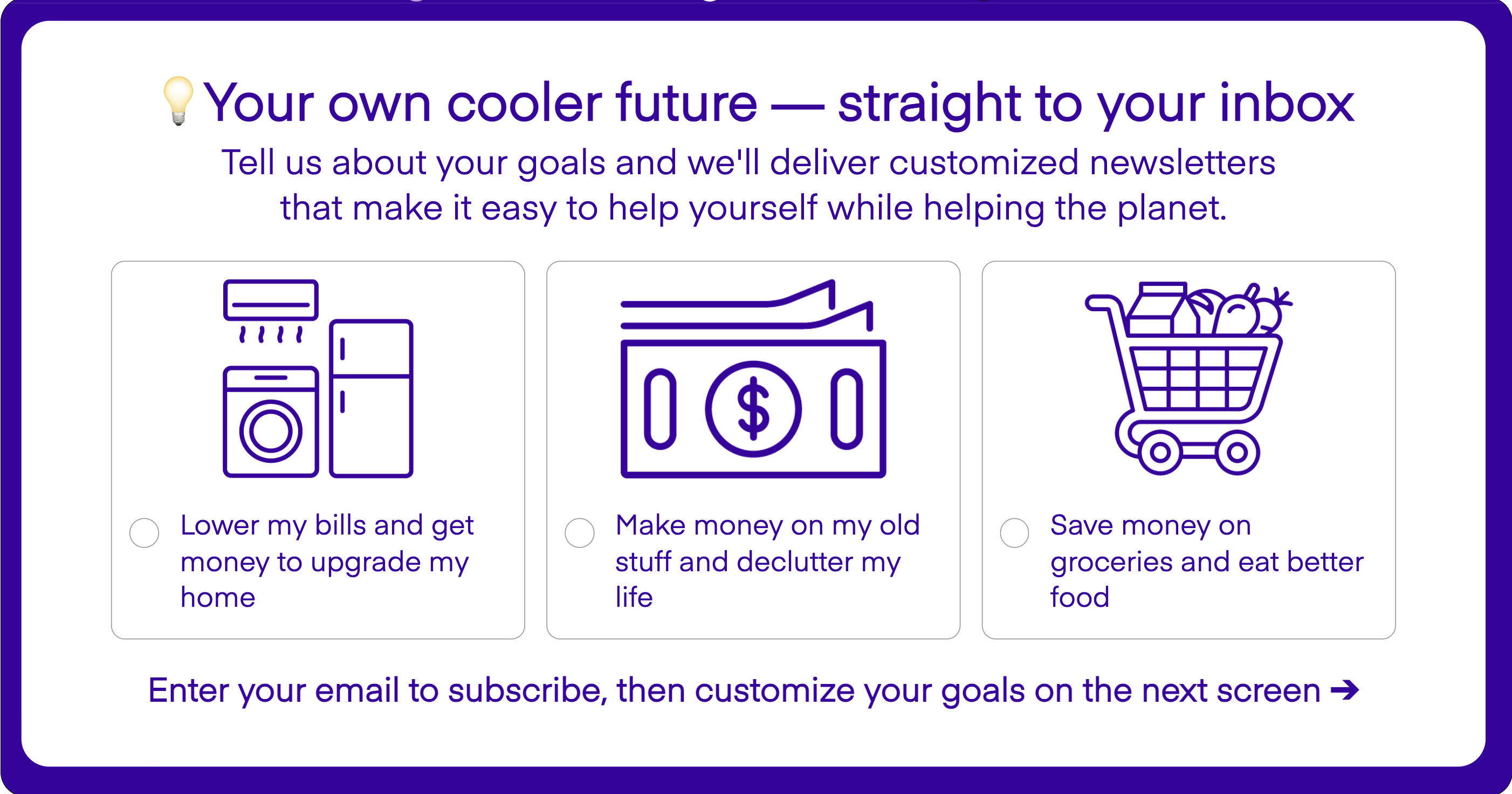

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.