Another hurricane has exposed the teetering nature of the home insurance market in one state.

What's happening?

In Florida, "commercial providers regularly fail or refuse to pay claims," Reuters reported. Last year, 50% of claims from homeowners to the state's six largest providers were rejected.

The Sunshine State is home to all but two of the 80 highest-risk ZIP codes in the country, according to the outlet, in large part because Florida is a peninsula that stretches between the hurricane-heavy Gulf of Mexico and the rest of the Atlantic Ocean. The state's Citizens Property Insurance Corp., founded in 2002, now covers 1.2 million homeowners.

The insurance crisis dates back to at least 1992, when Hurricane Andrew caused some insurers to stop doing business there, Reuters said. Since 2003, 41 insurance companies in Florida have declared bankruptcy or failed; that figure is just 37 for the rest of the country.

Floridians, on average, pay $4,060 per year, almost $1,000 more than those in any other state — and that's often before they purchase separate flood insurance. Premiums also rose 57% from 2019 to 2023, the highest jump in the country, per Reuters.

Why is this important?

"These are additional risks that, based on the fundamental principles of insurance, should not be present," Weiss Ratings founder Martin Weiss told the outlet. "Your insurance company is supposed to be your backup plan."

Hurricanes Helene and Milton, which recently made landfall just 13 days apart, devastated areas along the state's Gulf Coast and beyond. Florida's population has grown faster than that of any other state over the last three years, which means the real estate market is still buzzing despite the risk of natural disasters and the cost of insurance or lack of coverage.

"Rates are going to continue to just go up and up, insurers could go bankrupt, and Citizens will be on the hook to pick up that much more of the slack," Sam Boyd, a Sotheby's real estate adviser, told Reuters.

What's being done about the risks?

While the state-run Citizens program is one way to mitigate the insurance crisis — the nonprofit had $14.4 billion in July, and an official told Reuters it will not run out of money — the best way to deal with the problem is to lower the risk of natural disasters.

🗣️ Do you think your house could withstand a hurricane?

🔘 No way 😨

🔘 Maybe a weak one 🙁

🔘 I'm not sure 🤷

🔘 It definitely could 👍

🗳️ Click your choice to see results and speak your mind

Hurricanes and floods are becoming increasingly severe and damaging because of our consumption of dirty energy sources such as coal and gas. If we rely on solar and wind energy instead, for example, we can cut the amount of polluting gases in the atmosphere, lowering the rising global temperature and the consequences that come with it.

Try signing up for community solar, eating more plant-based meals, and swapping gas-powered car trips for bike rides. All these little things add up — but more importantly, you can use your voice to push for larger change by corporations and governments, where change can happen at an even larger scale.

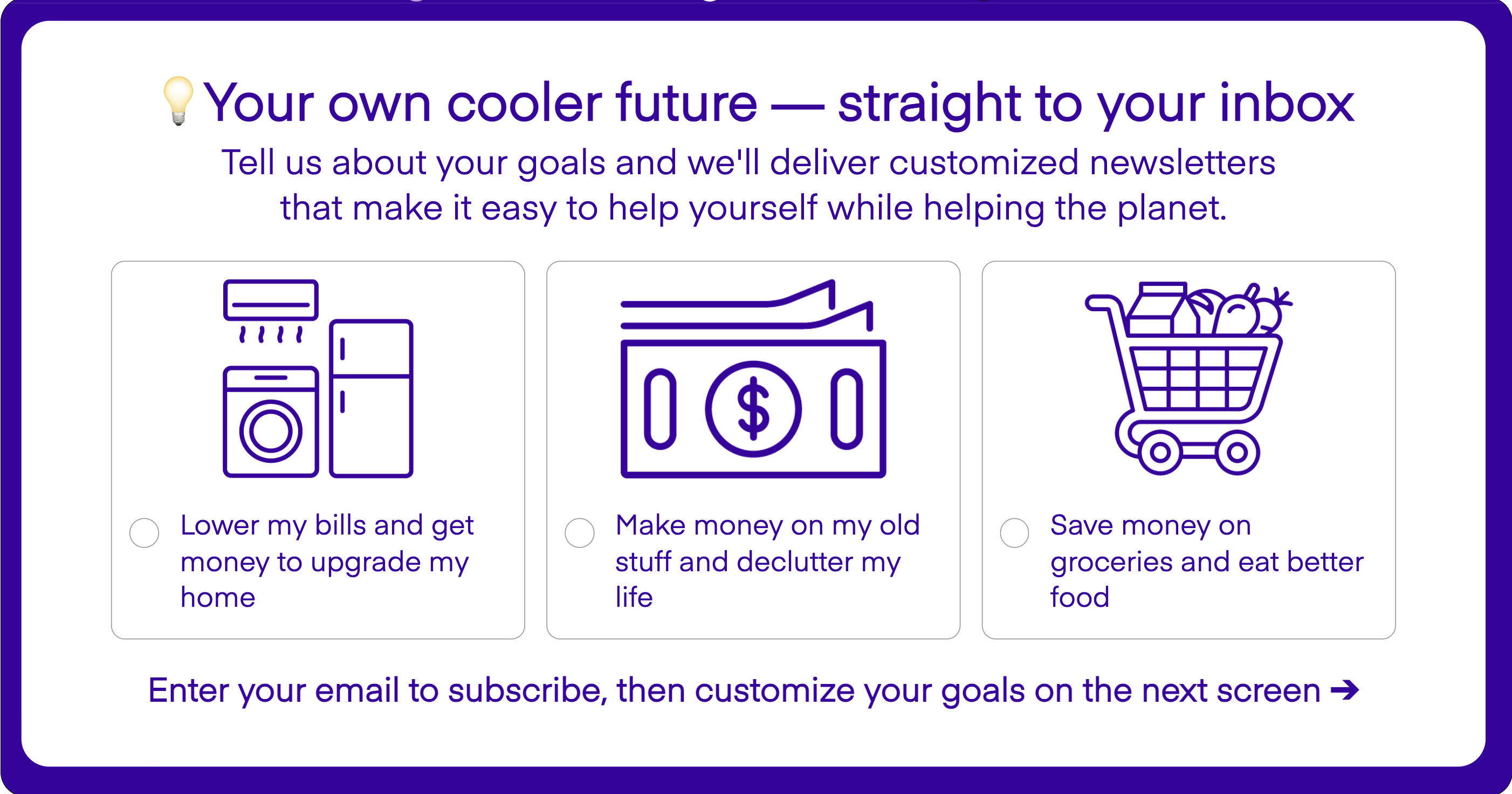

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.