Thousands of homeowners could soon be without insurance — just weeks after one of the country's worst natural disasters.

What's happening?

In November, 648,843 policyholders in Florida will have their home insurance moved from the state-run Citizens Property Insurance Corp. to private companies, as Florida Politics reported Sept. 11. The transfers will come just weeks after Hurricane Milton swamped the state and barely a month after Hurricane Helene, which made landfall in the Big Bend area where the Florida Panhandle meets the peninsula.

Helene killed hundreds of people in multiple states, including as far up the East Coast as Virginia, becoming the deadliest storm in the United States since Hurricane Katrina in 2005. It also is expected to be one of the costliest disasters in U.S. history.

In 2022, the Florida legislature approved a depopulation program for Citizens. It now has over 1.2 million insurance policies — more than it had then.

In August, the Office of Insurance Regulation said 10 private companies would take on 413,808 contracts. More recently, two insurers were added to the list to help take on 235,035 more, according to Florida Politics.

That may be little solace, however. Citizens says on its website that it "is committed to helping its policyholders find coverage in the private market," per Newsweek. However, private companies have grown wary of insuring homeowners in the Sunshine State, or they may charge exorbitant premiums.

Floridians pay $5,527 per year on average to cover a home valued at $300,000, per Bankrate. Home insurance rates in neighboring Alabama and Georgia are $2,745 and $2,071, which are $2,782 and $3,456 cheaper, respectively, for the same amount of coverage. The national average at the same home value is $2,285.

Why is this important?

Florida's high rates are because it is in a precarious position between the Atlantic Ocean and Gulf of Mexico, two places that churn out tropical storms. Those extreme weather events are increasing in intensity as the global and ocean temperatures rise. The risk means companies "regularly" can't or won't pay claims — as Reuters noted — and they stop offering coverage and leave the state.

Similar situations are happening across the nation, as floods, wildfires, and other risks make it less profitable for insurance companies to do business. Florida and California may be ground zero for this problem, but Iowa, Washington, and more states are experiencing the same issues.

🗣️ Do you think America is in a housing crisis?

🔘 Definitely 🙁

🔘 Not sure 🤷🏽♂️

🔘 No way 🏘️

🔘 Only in some cities 🏙️

🗳️ Click your choice to see results and speak your mind

State-run insurance programs are supposed to be a last resort, but they are taking on more policies — and more risk — as these private insurers bail out.

What's being done about Florida's insurance market?

"Florida's property insurance market has been unstable for several years, with rate hikes increasing substantially and companies fleeing the market, reducing their exposure in the state or going out of business," Florida Politics stated.

The Florida legislature has tried to work around the costs by restricting lawsuits against companies and subsidizing the industry, but if multiple hurricanes devastate one area in one season, there's little that would provide relief.

In the big picture, we must reduce our reliance on the dirty energy sources that are driving the climate crisis, leading to about 32 million displacements around the globe in 2022. Use your voice to plant seeds of change in your circle. You can also take action by volunteering or donating to conservation organizations to help make your community safer for the future.

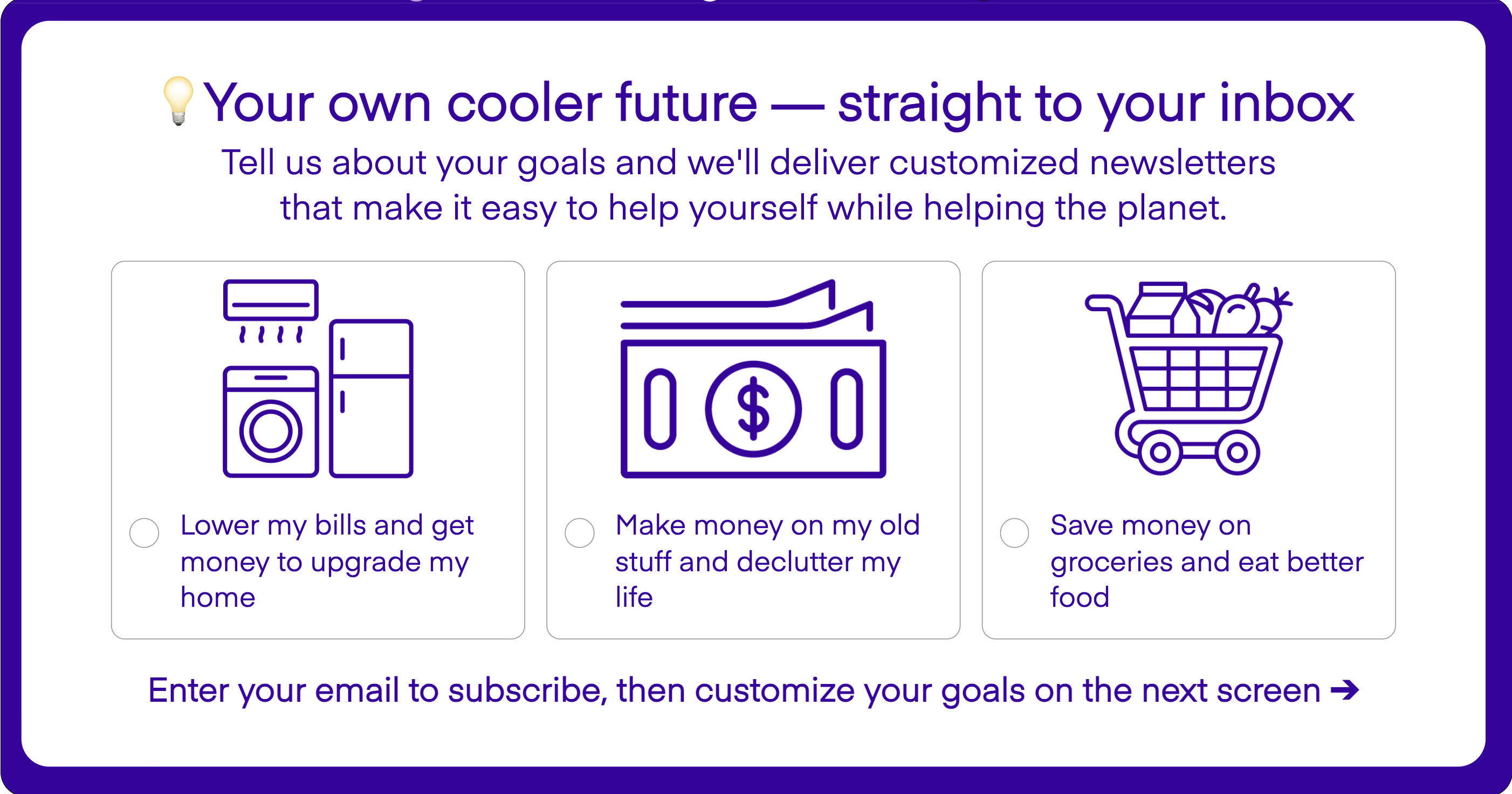

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.

!["[The] market has been unstable for several years, with rate hikes increasing substantially and companies fleeing the market."](https://www.thecooldown.com/wp-content/uploads/2024/10/image-recJ5s9KSX0NILZIl.jpg?w=1920&h=800)