For many Florida homeowners, it's starting to feel like the number one threat to their homes and financial security is no longer hurricanes — it's the insurance policies designed to protect them.

What's happening?

The largest insurer in the Sunshine State is Citizens Property Insurance Corporation, a state-owned provider created for property owners who are unable to find adequate coverage in the private market. But while Citizens was created to be an insurer of last resort, it's tripled in size in the last five years, with currently 1,263,055 active policies, per reporting from Newsweek.

This exorbitant growth has led officials to institute a new "Depopulation Program" designed to migrate a large percentage of those policyholders back into the private market. According to Citizens' website, this program "matches Citizens policyholders with insurance companies interested in removing their policy from Citizens and providing private-market coverage for their policy."

However, this has led many homeowners to face mandatory premium hikes, often accompanied by a decrease in coverage — leaving many of them feeling stuck.

Why is this pattern concerning?

Newsweek spoke with one Florida resident, Henry Williams, who said, "I can't afford to leave and I can't afford to stay." He mentioned that being priced out of the insurance market could lead him to lose his home — his only source of retirement savings.

"Even if we can sell, at this point, I foresee property values dropping drastically," he said. "It's a nightmare for everyone but hits retirees especially hard. I don't sleep at night."

This is not a problem that's limited to Florida. For years, human-generated pollution from the burning of dirty fuel sources has been warming the planet's atmosphere. In turn, these new conditions have been generating increasingly severe and erratic weather events.

This has created a complex problem for insurers, who need to remain profitable in order to remain in business. And with some areas generating more costly repairs and payouts than they bring in from premiums, many are pulling out of states altogether.

What's being done to help homeowners?

While several homeowners reported facing costlier, less adequate plans, Citizens spokesperson Michael Peltier remained confident that the Depopulation Program would actually benefit many.

🗣️ Do you think America is in a housing crisis?

🔘 Definitely 🙁

🔘 Not sure 🤷🏽♂️

🔘 No way 🏘️

🔘 Only in some cities 🏙️

🗳️ Click your choice to see results and speak your mind

"In many cases, policy offers are coming in at rates close to, or even below Citizens' premiums and/or with more comprehensive coverage," Peltier told Newsweek.

Outside of insurance, many homeowners are looking to protect their assets with community-led damage prevention, such as helping construct sea walls or creating wildfire buffer zones. And when homes are built or repaired, many are looking to use durable materials and designs that can hopefully keep them safe even in the face of intense weather.

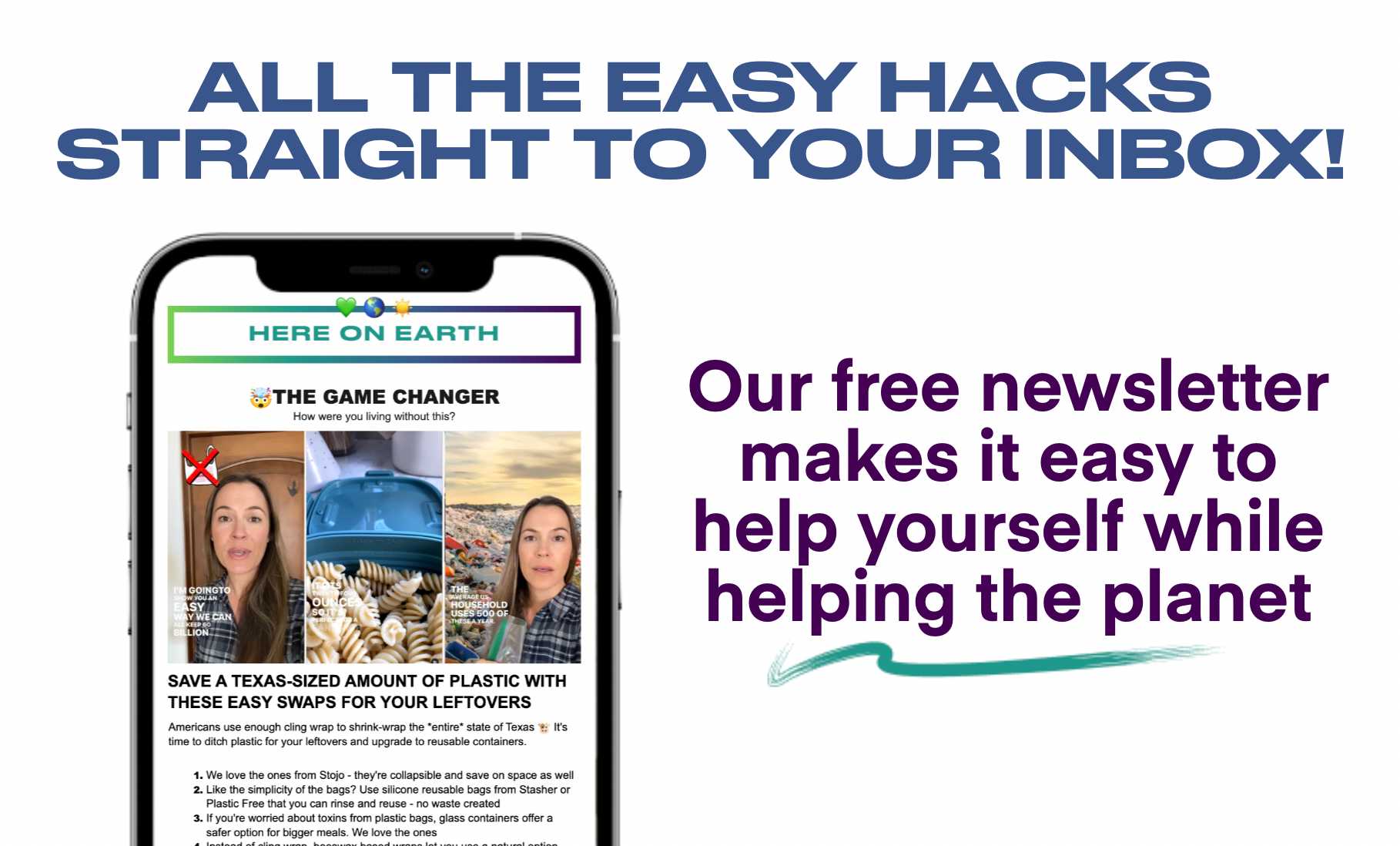

Join our free newsletter for easy tips to save more and waste less, and don't miss this cool list of easy ways to help yourself while helping the planet.